Are You Buying a House in Arizona? Here's Your Ultimate Guide

The Arizona housing market has been scorching hot for the past few years! As a desirable location for families, professionals, and retirees—it’s probably not going to cool down anytime soon.

Whether you’re a first-time buyer, a family wanting to upgrade to a bigger place, or a snowbird looking for a second home, this guide will help you understand the basics of buying a house in Arizona. Here are some burning questions we’ll answer:

- How much does my credit affect me in buying a house?

- What's my budget for buying a house?

- What’s the minimum down payment on a house for a first-time buyer?

- What’s the average down payment for a house in Arizona?

- Where are the most affordable homes in Arizona?

According to the U.S. Census Bureau,1 65.1% of Americans were homeowners as of the fourth quarter of 2024. Are you ready to join their ranks? Leverage this guide to prepare yourself for every stage of buying a house in Arizona.

First Things First

Before you even start thinking about buying a house in Arizona, the first thing you need to do is check your credit report and credit score. Why’s that? Because these are two of the most important elements that a lender looks at when considering whether or not to offer you a mortgage, how much they will loan you and what interest rate they’ll charge you for the loan.

Credit Reports & Credit Scores

Credit reports are like financial “report cards” that include specific information about your credit history, whether or not you pay your debts on time, the different types of credit you have and the status of your credit accounts.

You’re entitled to a free credit report at least once every year. Since the beginning of the pandemic, all three credit bureaus (Equifax, Experian and Transunion) have even been offering free weekly online credit reports. So, take advantage of this free service and request your credit report from all three bureaus through annualcreditreport.com. It’s worth reading the reports thoroughly and checking carefully for any errors or inconsistencies so that you can address them immediately.

Additionally, Copper State Credit Union members have free credit score access straight from their online banking dashboard. It doesn’t hurt your credit to check your score this way, plus you can receive personalized insights, alerts and credit monitoring. You can even set a credit score goal and watch your progression as you get closer and closer to hitting it.

Taking care of credit report errors might seem tedious or unnecessary, but it is 100% worth your time. Why? Because your credit score—which is a measurement of the information on your credit report—is a huge factor in determining the home loan interest rate you’ll qualify for.

A better credit score will get you a lower interest rate, so any errors on your credit report could be costing you literally thousands of dollars. Let’s do some simple math: for a 30-year mortgage, getting a 1% lower mortgage interest rate (3.75% vs. 4.75%) would save you over $80,000 on a $400,000 home loan!

If you’re not a math whiz—no worries—you can run the numbers through our mortgage payoff calculator. Also, you can check out specific examples of home loan interest rates and their impact on your wallet to see quickly how instrumental a good credit score is when applying for a home loan.

The importance of checking your credit report and score before buying a house was made undeniably clear by the Consumer Reports study2 of 6,000 Americans who volunteered to pull their own credit reports and share the results. Shockingly, more than one-third found errors.

If this happens to you, contact the credit bureau that made the error immediately. Complex errors may take more time and effort to correct, but the credit bureau is required by the Fair Credit Reporting Act to work with you to fix them. If you feel the credit bureau isn’t responding quickly enough to right their wrong, you can escalate by filing a complaint with the Consumer Financial Protection Bureau (CFPB).

Your credit score is crucial to getting you an “A+” home loan, so do not skip this step! And if you find that your score isn’t as high as it needs to be, don’t worry. Take a look at our credit score chart, which includes suggestions for how to improve your score significantly in just 6 to 12 months.

An easy credit-boosting tip is to make all of your debt payments on time—which means within 30 days of the due date. This one simple action contributes to about one-third of your credit score and can have a positive impact on it in as little as 12 months.

The bottom line is that a higher credit score equals a lower interest rate, which saves you a lot of money over the length of your loan! 💯

Budgeting & Typical Monthly Costs Of Buying A House In Arizona

Experts say you should follow the mantra of “budgeting before buying,” but why? Because, believe it or not, a lender might prequalify you for a mortgage amount that's more than you can afford!

Every financial expert recommends this simple rule to follow when it comes to housing expenses:

Put no more than 25% of your take-home income toward housing costs..gif?width=291&height=291&name=housing%20costs%2025%20or%20less%20(1).gif)

Even better, shoot for less than 25% because it leaves you more flexibility if something unexpected happens. But definitely do not spend more than 25% of your income on housing-related expenses.

If you're confident in your ability to create a budget without needing a lot of instruction, jump into it now by downloading this free budgeting template to help you start creating a workable budget.

But if it feels too overwhelming to dive in right away, you might want to read through our Budget Plan eBook first.

What Exactly Are My Housing Costs?

Great question! Essentially, your housing costs fall into two buckets: your monthly mortgage payment and home improvements/repair costs.

Your monthly mortgage payment, often summarized as P.I.T.I.H., combines five expenses: principal, interest, taxes, insurance and homeowner association (HOA) fees.

.png?width=1200&height=375&name=PITIH%20(1).png)

Let’s drill down into each of these.

Principal Payment

Your “principal” is the total dollar amount of the loan you borrowed. A portion of each monthly mortgage payment goes towards paying this off. Just FYI: At the beginning of the loan term, you won’t make a ton of progress in reducing that overall loan balance due to a process called amortization.👇

Through amortization, making even just one extra mortgage payment once a year or a larger down payment every now and again can drastically impact what you pay in total over the life of your loan.

Interest Payment

Interest is a fee the lender charges you for borrowing the loan money. The annual percentage rate (APR), the length of your loan (also called the term), plus the amount of money you borrowed all determine how much you’re going to pay every month in interest.

This also depends on an amortization schedule, which is a table laying out how much of your payment goes toward the principal and how much will go toward interest as your loan ages. In the beginning of your term, much more goes to paying the interest as opposed to the principal. Here's an example of the beginning, middle and end of an amortization schedule.

When the principal portion of the payment becomes more than the interest portion, you’ll see some speedy paydown action on that loan balance! 🎈This typically happens around years 12 to 16 of a 30-year mortgage—presuming you're making regular, on-time payments. Obviously, if you pay more in any given month, you’ll pay down the principal sooner.

Taxes

Property taxes are a part of your monthly payment that are paid in a unique way (more on this below).

Insurance

Homeowner insurance premiums are also a part of your monthly mortgage payment.

Typically, the lender funnels both the taxes and insurance into an escrow account, which is like a holding tank for tax and insurance funds. Then, when the insurance and taxes are due, the lender uses these funds to pay those bills. This is to ensure you have the money for taxes and insurance when the time comes. Look at it as an automated budgeting tool! This can also apply to private mortgage insurance, which we’ll discuss a little later on.

Homeowner Association (HOA) Fees

If you buy a house that’s part of a Homeowners' Association, you’ve bought into a private community that charges a fee to everyone living there. This fee would help cover the cost of maintaining a communal pool area or the landscaping of shared areas, for example. Sometimes, HOA fees can be added to your monthly mortgage payment. But if not, these fees are not connected to your mortgage loan amount or interest rate.

Home Improvement & Repair Costs

A great savings goal is to calculate 1% to 3% of your home’s value and stash it aside for improvements or repairs. This way, you’ll be able to afford that emergency plumbing visit when a pipe bursts or renovate that deck next summer. For newer or remodeled homes—which would need fewer repairs—1% is typically a good guideline.

Example: 1% x $350,000 home = $3,500 annually or $291 per month

For older homes or fixer-uppers, the higher end of this range—3% is a better bet since repairs or renovations will likely be more extensive due to the age of the house.

Example: 3% x $350,000 home = $12,250 or $1020 per month

Remember, accidents or emergencies are a matter of “when” not “if.” Being prepared and expecting these incidents to occur will set you ahead of the game!

Other Expenses That Could Be Included

Additionally, some experts include utilities like electric, water, and cable bills as part of housing costs, while others categorize this separately. Whether or not utilities are “officially” recognized in your housing costs, you should always factor them into your monthly housing expenses so that you can keep on track with your budget.

How Much Is A Down Payment On A House in Arizona?

For the two most common types of mortgage loans, here are the minimum down payment requirements you’ll see.

Conventional Mortgage Minimum Down Payment

Typically, a minimum of 5% of the purchase price is needed for a down payment with a conventional loan. As an example, for a $350,000 home, this would be $17,500.

However, in some cases, the minimum down payment for a house for a first-time buyer can be as little as 3% if they do homebuyer counseling and have good credit!

Federal Housing Authority (FHA) Loan Minimum Down Payment

An FHA loan is a type of loan program backed by the federal government so that folks with a lower income can afford to buy a home. A minimum of 3.5% of the purchase price is needed for an FHA loan down payment. Using the example above, this would be $12,250 for a $350,000 home.

Why Have I Always Heard “You Need A 20% Down Payment”?

You’ve probably heard this because homebuyers tend to get the best rates when they contribute 20% of the purchase price as their down payment. This percentage is a lot, though: for a $350,000 home in an affordable Phoenix suburb, 20% would equate to a whopping $70,000 down payment!

Conversely, if you put down less than 20%, you’ll likely have to pay for Private Mortgage Insurance (PMI). PMI is a type of insurance the homeowner pays that’s beneficial to the lender. Why does the homeowner have to pay for this? Because it provides a safety net if the homeowner can’t pay back the loan and the house goes into foreclosure.

PMI is typically 0.5% to 2.0% of the loan amount, which you pay on an annual basis. In the example above, if you could only submit a 10% down payment on a $350,000 home, you might have to pay an additional $17,500 every year.

So, as you can see, your average monthly mortgage payment will differ quite a bit based on the down payment you make.

Your credit score can also impact what you pay for PMI. With some types of mortgages, you can have this insurance canceled once you reach a certain equity position. To explain: the more mortgage payments you make, the higher your equity (ownership) you have in the house. Some homeowners might have to pay PMI for the life of the loan unless they refinance.

It’s a smart move to start saving up money long before you jump into the house-buying pool. Even a small start is a huge win over not starting at all. Research shows that opening a separate savings account and naming it with your specific goal, such as “House Down Payment,” motivates you to save more and reach your goal faster!

To help you build savings for a down payment, our savings accounts are free of charge when you sign up for eStatements.

You can also check with your lender to see if you qualify for any Arizona down payment assistance programs which are often available to first-time homebuyers.

So, Can You Afford A Mortgage?

This mortgage affordability calculator is one of our favorite tools for walking you through the process of deciding how much house you can afford. All you need to do is give us a little information and the calculator will tell you how realistic it would be to pay a monthly mortgage based on your income. Be sure to have some approximate numbers ready for your other regular expenses.

Other Copper State CU tools that may help during this step:

You’re The One That I Want

Maybe you’ve always known exactly what you want in your dream home. Or maybe you have no idea! Either way, it’s a good idea to write down your must-haves and share them with your real estate agent. In a competitive market, you may not get everything you want, but at least your agent is aware of what’s important to you as he or she sends listings your way.

It also may help to poke around online to see what houses are available, in what locations, and with what amenities because this helps you ensure your list is realistic and in line with your price point.

Popular home search areas in Arizona include Glendale, Phoenix and Scottsdale, to name a few. Most importantly, don’t forget to be clear about what you DON’T want in your new home! If there are non-negotiables (i.e., you despise pool maintenance), you may want to share that with your agent as well.

Reminder! Do not actually look at houses until you’ve made sure your credit score is in good shape and you’ve created your budget. You don’t want to fall in love with a property that’s outside of your price point.

Now, Collect Your Documents

Not going to lie—one of the most cumbersome parts of buying a house in Arizona is gathering all the documentation you need!

From tax returns to bank statements, there’s a lot of work on your end to get these items together for your lender. To make it easier, we put together a handy checklist: House Buying Checklist: Mortgage Documents You’ll Need. Take a look and start getting these documents together.

Find A Realtor And Lender You Trust

Once you have taken care of the basics (credit check, budget, down payment and home preferences), it will be time to assemble your home loan team of experts: a realtor and an experienced mortgage lender.

Realtor Tips: There are two types of realtors: Listing agents and buyer’s agents. Listing agents work for the seller of the home. It’s worth considering finding a buyer’s agent to represent your needs instead of using the same realtor who is working for the seller because listing agents will, understandably, care more about the seller’s priorities than the buyer’s. The listing agent and the buying agent will split the commission fee for the sale of the house, which is usually 5% to 6% of the purchase price.

Lender Tips: You want a lender who offers competitive rates, quick turnaround on loan processing and low closing costs. Credit unions in Arizona are a reliable choice for mortgage lenders due to the typically lower interest rates and lower fees they offer, plus the excellent service they provide for their members. Speaking of service, since credit unions exist for their members as opposed to shareholders, the members’ priorities are top of mind. Many Arizonans don't even realize that their local credit union can do a first mortgage for them!

Once you’ve found your realtor and lender, you are ready to start the pre-approval process.

Choose Your Mortgage Type & Get Prequalified

Choosing which type of mortgage will fit your situation best is a tricky business, which is why we love to use this comparison tool on mortgage types.

After the application is complete, and as long as you meet the criteria as a borrower, your credit union mortgage specialist will provide you with a prequalification letter for a certain amount. That prequalification letter is like having an engagement ring when going wedding dress shopping. It lets sellers know that you are ready, willing and qualified to purchase their home— and gives you the freedom to make an offer as soon as you're ready.

Pro Tip: Prequalification letters are only valid for 60 to 90 days, so wait until you’re fully ready to start looking for a home before you take this step.

To get prequalified, you’ll only need a few personal documents, like pay stubs to prove steady income and bank statements that show available funds for a down payment. Later in the process, you’ll need a lot more documentation.

Now comes the fun part! Online resources such as Trulia.com, Redfin.com, Realtor.com and HomeFinder.com are excellent places to start if you don’t know what you’re looking for yet (or even if you do). It’s a convenient way to narrow your home search without getting up from the couch! You could probably view ten properties per hour online, whereas driving to a house, walking through and chatting with your agent could take an hour for just one listing.

Play around with customizations in your search to include the desired number of bedrooms, price, location, acreage, etc. You may even want to read our ranking of the top 10 best neighborhoods in Phoenix if you’re searching in the Phoenix real estate market for a house.

Once you’ve browsed online and have a better idea of the types of houses you’d like to see in person, it’s time to visit the properties.

Open house events offer a convenient and stress-free way to see many homes in a short amount of time. Or, your agent may have access to a lockbox for homes that are unoccupied and can let you in to view the property that way.

Make a list of open houses in your area of interest and do a few visits, making sure to take notes and pictures of each home so that you can remember their features later. You may even want to bring your home preferences list with you so that you can revise it as you browse houses.

Don’t forget to take into account the neighborhoods as well. When you buy a house in Arizona, you’re not just purchasing the residence but also the community in which the home is located.

Take some time to scope out local shopping, restaurants, schools and maybe even meet the neighbors! You’ll know better if the community or neighborhood is a good match if, after spending a day in the area walking or driving around, you feel your needs are met.

Pro Tip: Visit the community more than once, at various times of the day and evening. This gives you a full picture of the area you’re potentially going to live in. Walk around the neighborhood and chat up homeowners who are outside doing yard work or washing their car. Insider info is the best!

Buying A House In Arizona: From Offer To Owner In 10 Steps

Once you've found THE one, follow these ten steps that will take you from offer to owner:

1. Press Pause On Other Big Financial Decisions

The importance of this step cannot be overstated. Once you’ve decided to buy a house in Arizona, especially if you’ve gotten prequalified or made an offer, understand that any changes in your financial situation can jeopardize your home loan!

Seemingly small actions like applying for a new department store credit card or inquiring about a new car (with a credit check) can affect your credit report and scoring—possibly even preventing you from completing the mortgage closing process. What’s more, it can also negatively affect the rate or the terms of your loan.

And it’s not just credit pulls that will impact your house-buying experience. Here are some other pieces of advice to follow during this critical time:

- Stay with your current employer

- Avoid increasing your debt

- Wait on other large purchases such as furniture

- Keep cash where it is––unexplained transfers and withdrawals of large amounts of cash are red flags to your mortgage team

- Continue making regular, on-time payments to your other debts or bills

2. Your Agent Will Make An Offer On Your Behalf

This is why prequalification is so important! Once you find that dream house, you’ll be eager to buy it! But talk with your real estate agent about the details because he or she may have inside information about the seller or the property that could structure your offer in different ways.

For example:

If the house has been on the market for over a year and the seller already has another house in upstate Arizona, they may be highly motivated to sell, even if it’s for slightly less than the asking price.

Conversely, if the house has only been on the market for a week and your agent knows that twelve other buyers have looked at it during that time, they might advise you to offer the asking price—or even higher—right out of the gate.

When you agree on the offer’s details, your agent will draft a Purchase Agreement and send it to the seller’s agent. Once signed by both parties, the Purchase Agreement is a legally binding document.

3. Seller Responds To The Purchase Agreement

The seller and his/her agent will review the purchase agreement carefully.

Purchase agreements typically include:

- Buyer and seller information

- Property details

- Pricing and financing

- Fixtures and appliances included or excluded in the sale

- Closing and possession dates

- Earnest money deposit amount

- Closing costs and who is responsible for paying what

- Conditions for termination

- Contingencies such as financing, inspection, appraisal and prior home sale

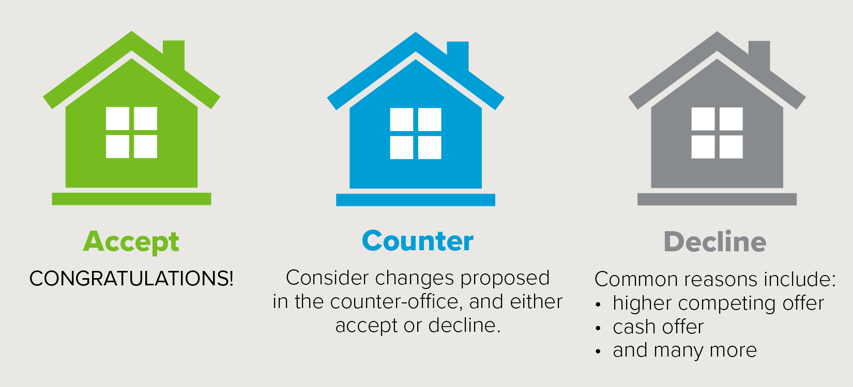

Based on these details, the seller will do one of three things: accept your offer, return with a counteroffer or outright decline.

4. Time To Get Earnest

Once both parties have signed the purchase agreement, it’s time for you as the buyer to put down your “Earnest Money,” also known as a “Good Faith Deposit.”

This is a deposit towards the purchase of the home that’s made by a buyer to show they’re serious about completing the transaction.

If you’re buying a house in Arizona, expect to put down about 1% of the purchase price, which will later be applied as part of your total down payment. As an example, for a $400,000 home, you’d need $4,000 to meet this 1% requirement.

5. Closing Costs And Signing Of Disclosures

During this step, you’ll receive a packet of disclosures from your mortgage lender that you’ll need to review. Included will be an itemization of what you owe for closing costs. Remember, closing costs are a different expense from your down payment!

Closing costs typically fall into three categories:

- Prepaid Items (HOA dues, insurance, taxes)

- Lender Fees

- Third-party fees

You’ll need to have 3% to 5% of the loan amount on hand to pay the closing costs at the time you sign the final documents. Closing costs can include any items from the following list.

|

|

6. Appraisal And Inspection

Many people incorrectly think that the appraisal and the inspection are just different names for the same thing—but they actually serve completely different purposes!

Home Appraisal: Assigns A Value To The Home

An appraisal is an unbiased professional opinion of the home’s value. Qualified appraisers create a report based on sales of similar properties, a visual inspection and details of the home like square footage, number of bedrooms and baths, town location, etc.

The appraisal value can affect the home purchase if it comes back much higher or lower than anticipated. In Arizona, the mortgage lender almost always requires an appraisal.

Appraisal fees are in the “prepaid” category of the closing costs listed above, which means you’ll pay when the appraisal takes place, not at the closing. This fee is collected by your lender when the appraisal is ordered and will usually come in around $400 to $800 for homes in Arizona.

Home Inspection: Assesses The Condition Of The Home.gif?width=300&height=500&name=Inspection%20appraisal%20(1).gif)

The inspection, on the other hand, focuses on the condition of the property.

You’ll set up the inspection on your own, but your agent can help you find a qualified inspector. The inspection will give you valuable information about the home you’re buying so that you know potential issues that you’ll be responsible for taking care of with your money—not the seller’s.

An inspection can provide you with leverage in negotiating with the seller if something about the home is unacceptable.

7. Title Search And Title Insurance

The home you’re buying is required to undergo a title search. This is done by your lender and is often completed by a partner title company. This public records search tells you who the legal owner of the property is and ensures that there are no claims to it by another person. Once this is complete, you’ll pay for title insurance (via closing costs), which is valid for the life of the property’s ownership.

According to Investopedia7, title insurance protects lenders and buyers from financial loss due to defects in a title to a property. The most common claims filed against a title are unpaid taxes, liens and conflicting wills. A one-time fee paid for title insurance covers potentially pricey administrative fees for deep searches of title data down the line.

8. Homeowners Insurance

Also known as “hazard Insurance,” this protects your new home against hazards such as lightning, fire and theft. For some homes subject to the risk of flooding, you may also have to pay separately for flood insurance.

Your lender will ask for proof of homeowners insurance before you can close on your home, so you’ll want to get this process started 2-3 weeks before your closing date.

9. Final Walk-Through Of Your Arizona House

You’re almost at the end of the tunnel! About a week before closing, you’ll walk through the property with your agent to ensure that:

- All of the components of the Purchase Agreement were upheld by the seller.

- Nothing about the property’s condition has changed.

This is when you’ll verify that any previously agreed-upon repairs were actually completed by the seller. It’s also the final step you’ll take before signing the paperwork and closing on your Arizona mortgage!

10. The Arizona Mortgage Closing Process

Your mortgage lender will be gathering updated financial information from you, such as recent pay stubs and bank statements, in the weeks leading up to the closing. They’ll also pull your credit report again to ensure nothing has changed. Expect another employment verification and confirm that your funds for the closing are available.

When you show up to sign closing documents, bring a valid photo ID, such as a driver’s license or passport. You’ll need to have the remainder of the down payment and closing costs ready for payment at this time.

Although some will accept a certified check at the time of closing, many title companies now require those funds to be wired ahead of time. You’ll sign your name about 348 times (kidding—not kidding!) and then receive the keys to unlock your future location of happy memories!

WHOO HOO! Congratulations on closing on your new Arizona home!

✨ Your Arizona home journey doesn’t stop here! 🏡 Want to feel confident at every step of the process? Download our free Arizona Homebuyer’s Guide — packed with insider tips, checklists and resources to make your path to homeownership smooth and stress-free. Just fill out the form below and click the blue button to grab your copy!

Download the free eBook now:

Sources:

1 U.S. Census Data https://www.census.gov/housing/hvs/files/currenthvspress.pdf

2 Consumer Reports https://www.consumerreports.org/credit-scores-reports/consumers-found-errors-in-their-credit-reports-a6996937910/

3 https://thehillgroupaz.com/blog/earnest-money-in-arizona/

4 https://www.investopedia.com/articles/pf/12/home-appraisals.asp

5 https://www.thebalance.com/what-is-escrow-315826

7 https://www.investopedia.com/terms/c/closingcosts.asp

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval.

.png?width=1000&height=300&name=35%25%20of%20your%20Credit%20Score%20(2).png)