HELOC vs Home Equity Loan: Advantages of Cashing Out On Your Home

With home values higher than ever before, many folks are looking to fund home improvement projects or other expenses by using the equity in their home. Let's define a few terms and then compare the two most popular home equity based loans: HELOC vs Home Equity Loan.

What Is Home Equity?

While we have a whole post answering this question (click "What Is Home Equity" above to learn more) the short version is this:

Home equity is calculated as the value that would be returned to you if your home was sold and all your home-related debts were paid off. For example, if your home sold for $500,000 and you owed $300,000 in loans on the property, the value returned to you would be $200,000. For this example, your home equity would be $200,000.

But the key to understanding home equity installment loans and home equity lines is the fact that you don't have to sell the home to take advantage of the equity you have in it.

1st and 2nd Mortgages Defined

A first mortgage holds the 1st lien position on the property (in simpler terms, it's first in line to get paid.)

A second mortgage holds 2nd lien position on the property (or is the 2nd loan to get paid, after the 1st.)

To a homeowner, these definitions don't matter a whole lot. But generally, the HELOC and Home Equity Loan options we'll discuss below are both referred to as 2nd mortgages, which is helpful to note.

If you're someone who has already paid off your home's 1st mortgage, your HELOC or Home Equity loan would then be in first lien position, rather than second. 😵 Confusing, we know.

First up in the HELOC vs Home Equity Loans battle: HELOCs.

Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) is a line of credit that allows you to tap into your home’s equity.

Somewhat Like a Credit Card.gif?width=300&name=gif%20(2).gif)

Like a credit card, a HELOC is a revolving line of credit that allows you to borrow up to a certain limit, pay it off, and then borrow it again. That limit is determined by a percentage that the lender sets for you called the LTV (loan-to-value).

The LTV is the ratio of how much you owe on your home versus how much it’s actually worth. Don't worry about calculating LTV on your own - instead, contact one of our loan specialists to give you a customized answer. Copper State Credit Union's LTV maximum for HELOCs is 80% - we won't allow anyone to borrow more than 80% of the home's value with a home equity line.

Time Limits? Weird.

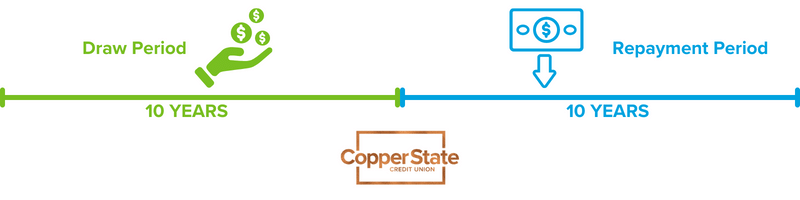

For a HELOC, first there’s a draw period. This is generally a 10-year period where you can withdraw and use the money in a HELOC. You’ll often still need to make payments during this phase and those payments will go toward paying interest and the rest going to reducing your principal balance. You can even draw the full amount of the HELOC and pay it back multiple times within this ten years.

Next up is the repayment period. Once you reach the repayment window, you’ll no longer be able to borrow money. You'll start repaying the principal plus interest you've accumulated. Repayment period generally lasts 10 years as well.

Would I Qualify?

In order to qualify for a HELOC, you’ll need to prove to your potential home equity lender that you will be able to pay back any money you borrow. Your lender will consider your debt to income ratio (DTI), your credit score, and the value of your home. The home equity lender that you choose for your HELOC does not have to be the same as your mortgage provider.

Risky Business

Before jumping headfirst into a HELOC, it’s important to be aware of the risks associated with it. First and foremost, a HELOC requires you to put your home up as collateral in exchange for the credit line.

This means that if your situation changes drastically and you’re suddenly unable to make your payments, you risk losing your home. You also reduce your equity in your home when you use a HELOC, because you're increasing the debt that you owe against it. That's a fancy way of saying when it comes to equity: you use it, you lose it.

Plus, a HELOC isn’t free money. There are fees associated with opening and maintaining it. Copper State Credit Union doesn't charge maintenance fees, just origination fees for the work that goes into setting up the loan.

Another item to note is that HELOCs have variable rates. This means that they change with market factors. You may be able to start out with a low home equity loan rate at the beginning, but it could rise to something that is much less attractive. Example: if your variable rate goes up, your payment won't change but the pace at which you pay down the balance will. (It'll take longer.) Or vice versa! You never know what the market will do...

When Is a HELOC Right for You?

Deciding if a HELOC is right for your situation will mean considering all of your debt, your risk tolerance, and what you want to use the money for. One of the most common uses for a HELOC is to renovate or improve your home. Interest on HELOC payments used for these purposes can be tax-deductible and may have a lower interest rate than a credit card or other loan options.

Another big thing to consider is how much of the loan will you need and when. Take a look at our example:

Julianna wants to use her home equity to replace the flooring in her home. However, she wants to go one room at a time. So she'll only need about $2,000, then will be able to pay it back. By the time she's finished, she'll have done that 6 times. For her situation, the HELOC is a good option because she's not taking all $12,000 out at once. She'll likely pay less interest overall than if she went with a Home Equity Loan.

Does a HELOC sound like something you might be interested in? Fill out our interest form to have a loan specialist contact you and talk you through your options.

To understand this example a little better, let's now compare HELOC vs Home Equity Loans.

Home Equity Loan

If you need extra funds and are comfortable with the idea of borrowing against the equity of your home, another option could be a Home Equity Loan. This is another type of 2nd mortgage. However, rather than being a credit line, it's a lump sum that you borrow initially and then immediately start paying back over a set term (Copper State Credit Union offers 5 year, 10 year, and 15 year term options.) That's why it's sometimes referred to as a home equity installment loan.

Kind of Like a 1st Mortgage.gif?width=300&name=gif%20(1).gif)

Home Equity Loans are sometimes referred to as closed-end second mortgages. They behave more similarly to a regular first mortgage. It follows the traditional borrowing pathway where you borrow an amount, and pay it back with interest, just like you would for a car loan or 1st mortgage.

This type of loan also typically offers fixed rates, which means the rate can't go up or down based on whims of the market. Home equity loans have a minimum of $15,000 and a maximum of $350,000 at Copper State Credit Union and you can borrow up to 100% of your home's appraised value as long as it falls within that range.

Would I Qualify?

In order to qualify for a Home Equity Loan, you’ll need to prove many of the same things to your potential lender that you would for a HELOC. They'll look at whether you're able to repay the amount you want to borrow, as well as considering your debt to income ratio (DTI), your credit score, and the value of your home. It also depends on your LTV (loan-to-value). The LTV is the ratio of how much you owe on your home versus how much it’s actually worth. Don't worry about calculating LTV on your own - instead, contact one of our loan specialists to give you a customized answer. Copper State Credit Union's LTV maximum for Home Equity Loans is 100% - we won't allow anyone to borrow more than 100% of the home's value. (Makes sense, if you think about it...)

Risky Business II

Ok, so the first and biggest risk is the same as that of a HELOC: your home is the collateral. If you can't make payments on this 2nd mortgage, you're at risk of losing your home. Also the same? You use it, you lose it when it comes to your home equity. If you take out a 2nd mortgage on your home, all that equity is GONE until you pay the amount back.

On the fees & rates front, HE loans are a little different than HELOCs. As we mentioned, HE loans have a fixed rate for the term of the loan. The fees - at least at Copper State Credit Union - are the same for both HELOCs and HE loans. We charge origination fees for loan setup but then no maintenance fees after that.

Back to Julianna's example! If, instead of doing her new flooring piecemeal, she was doing the whole house all at once for $12,000, she might prefer to take out a home equity loan. She gets the entire amount up front and will pay a fixed rate over the repayment period.

Conclusion

What we didn't talk about is when folks use home equity to pay for other things like medical bills, education expenses, or for debt consolidation/payoff. While using a home equity loan for one of these other purposes is perfectly acceptable in the financial world, you'll want to be sure that you're OK putting your house on the line for that cause. If you pay off your debt with a home equity loan or HELOC and then run up more debt, you may be gambling with one of your most important assets - your home. See our Cash Out Refi course for more details on the debt spiral we want all our members to avoid.

Interested?

Take the time to speak with a loan specialist so that you can see if your goals and your financial situation can intersect at a home equity loan or HELOC. We take pride in giving our members an honest answer - which is sometimes "No, this isn't a good idea." But it can't hurt to get some expert advice, right??

Feel free to call for loan consultation at 623.580.6000 or fill out our interest form to get started. No obligation! 👇

Maybe this article wasn't for you because you're in the process of buying a house instead? Don't worry, we've got you covered.

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. All loans subject to approval. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications and collateral conditions.