Credit Score Chart + 5 Key Factors

Let's cut to the chase... Are you a current member at Copper State CU?

👉 Not Yet - That's ok! This article is about to dive deep into a special member tool. If you're not already a member and want to join, it's super easy. Just tap on the big blue 'Join' button on the top right corner of the webpage to get started online. You can also open an account by giving us a call or visiting a branch in person.

👉 Yes - Sweet! You already have access to online banking. This is where you log in on your mobile app or computer to check all of your accounts with us. Here, you'll find a special widget we provide: Copper State Credit Union's Free Credit Score tool. This credit score is not a hard inquiry or hard pull on your credit, and it won’t show up on your report or affect your score. Win. ✅

To make sure you know your credit status at all times, check your online banking to see the free credit score widget pop up on your dashboard.

When you tap into it, the tool allows you to:

👍 See your credit score and what activity has influenced it.

🎯 Create a credit score goal and track progress toward it.

💭 Simulate what could happen to your credit score if you were to apply for a loan or pay off a loan.

🚨 Monitor credit alerts, helping you spot potential fraud on your credit report.

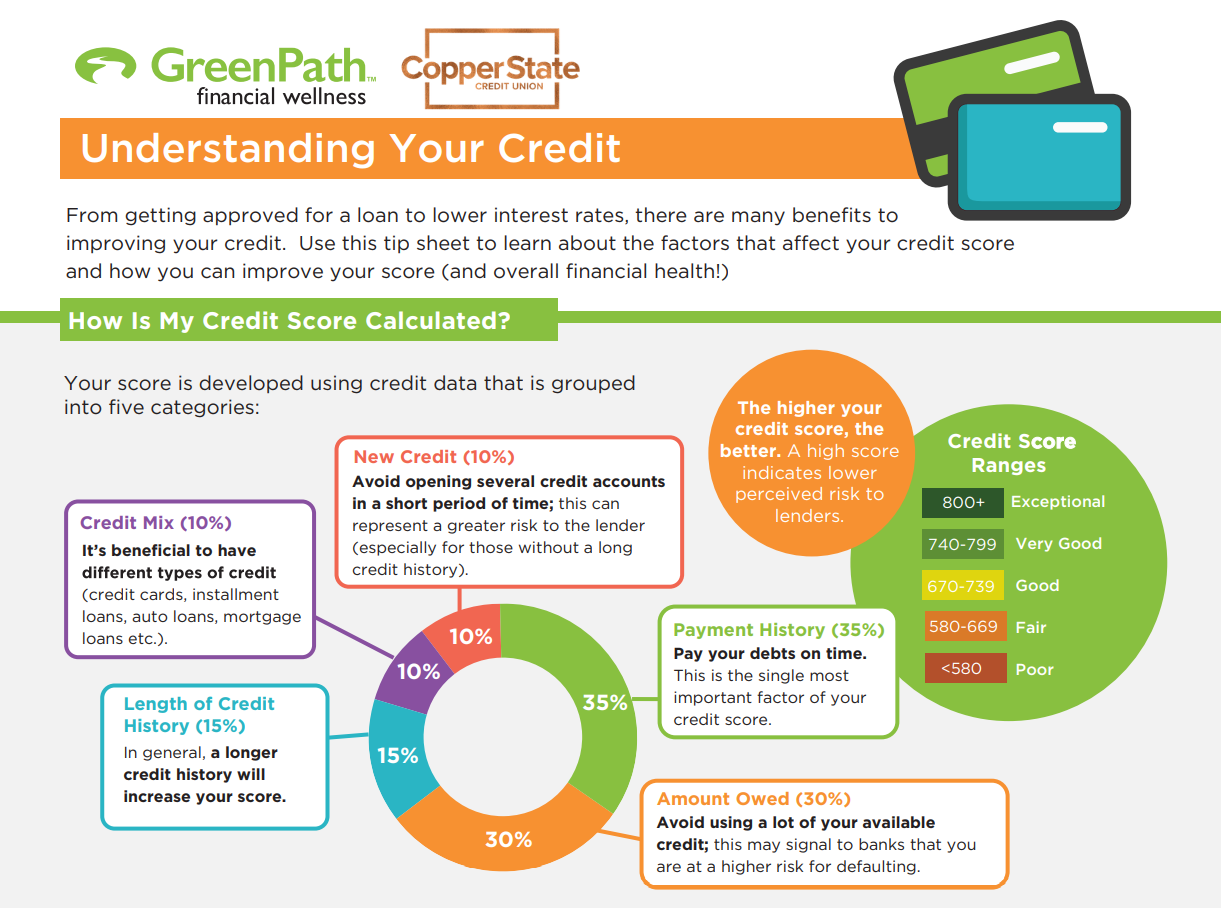

Now that you have your credit score on hand, let's answer the questions many people are wondering: how is my score calculated, what is a good credit score, and what's the best way to track it? Enter: this credit score chart. We'll dive into more detail below the graphic! 👇

How Is My Credit Score Calculated on a Credit Score Chart?

5 Major Factors Impact Your Score

Based on the credit score chart above, you can see that a credit score is developed using data from about 5 categories, often including:

Payment History

Credit Utilization (Amount Owed)

Length of Credit History

Credit Mix

New Credit

1. Payment History and the Credit Score Chart

The single biggest factor on the credit score chart, making up 35% of your score, is simply paying your debts on time.

-1.gif?width=249&height=321&name=Untitled%20design%20(5)-1.gif) Missing just one payment can lower your score as much as 100 points.

Missing just one payment can lower your score as much as 100 points.

A late payment (for credit reporting purposes) refers to payments 30 days or more past due. 20% of Americans had at least one payment 30+ days overdue in the past calendar year, according to a recent study by FICO.

If you’re having trouble making a payment, you’re better off calling the creditor to work something out instead of just skipping the payment and ignoring the problem. Here's one resource that may help: I Can't Make My Credit Card Minimum Payment - Now What?

2. Amount Owed and the Credit Score Chart

-1.gif?width=310&height=400&name=Untitled%20design%20(4)-1.gif) 30% of your score is determined by how much of your available credit you are using at a particular time.

30% of your score is determined by how much of your available credit you are using at a particular time.

Another term for this is credit utilization.

For example, if your credit card has a $10,000 limit, that means you have $10,000 in available credit for that particular card when you start out. If you've spent/used $5,000 of that, your utilization rate or amount owed is 50%. You're borrowing half of what's available.

When utilization rates are high, this is a warning sign to the credit bureaus that you may not be able to handle all of your expenses and payments on that debt. Americans' utilization average hovers around 30% as of April 2021.

When possible, keep your credit utilization rate to less than 15% of your total credit available. Use it, pay it down, repeat.

Having trouble paying down your debt? Get Our Debt Relief Bundle for free and get started on the path to a debt-free lifestyle.

3. Length of Credit History and the Credit Score Chart

The next biggest factor, at 15%, is the average length of time you’ve had open credit.

If you’re young, you don’t have much control over this factor – which is why younger people have a harder time bumping up their credit score quickly. Some of it just comes with time! Secured credit cards or secured loans are a great way to start building credit if you don't have any. You can also become an authorized user on a family member's credit card.

For adults over age 30, the best thing you can do in this arena is to avoid closing accounts that have been held for a long time. Did you open a credit card when you were 18 and still have it? Great! Don’t close the account if you don’t have to, because this would shorten that average length number.

Curious about how average length is calculated? Think about how long you've had your mortgage (6 years), your auto loan (2 years) and your credit card (10 years) - the average of these? 6 years. This is similar to the calculation done on your credit report.

4. Credit Mix and the Credit Score Chart

-3.png?width=800&height=400&name=Untitled%20design%20(23)-3.png)

Mix it up! A credit mix simply means that you have different types of credit in your name. Here are some of the different loan types explained, with a list of the most common ones below.

Installment loans – i.e. Car Loan

Regular payments are made over a certain period of time, usually with interest. After repayment, the account is closed. If you're looking to buy a vehicle soon, check out How to Buy A Car: 3 Simple Steps to help you get started.

Revolving loans – i.e. Credit Card or Line of Credit

Borrow up to the limit, pay it back, borrow it again. You can pay in full each month to avoid interest charges, or make minimum payments and carry a balance, paying interest charges each month.

Mortgage loans – i.e. Home Loan

Related to property owned, can be fixed or variable rate. Usually repaid over 15-30 years.

Open accounts

This is the type of account where balance is due to be paid in full each month, such as a collection account.

Don’t worry if you don’t have the perfect mix of credit types. Not many people do! This is why this category only counts for 10% of your score. Many folks naturally acquire different types of credit over time. 😘

5. New Credit

Funny enough, your credit score will take a hit if you apply for several new credit accounts within a short period of time. This can be an indicator of an inability to repay, especially when combined with short credit history.

Tip: You can still shop around for a good lender if you're on the road to a new car or house – just make sure all inquiries of the same type are done within 14-45 days and they’ll all only count as one hard inquiry. Why such a range? The newest credit scoring model uses a 45 day shopping window, but some of the older ones cut it off at 14 days.

What is a Good Credit Score on a Credit Score Chart?

Credit Score Chart and Ranges Explained

My Credit Score is 800+

You really are extra, in a good way. If you have a credit score over 800, your credit is considered to be Exceptional. Only 20% of Americans have a score over 800. With this score, you can likely qualify for the lowest possible rate on loans, as well as some great rewards credit cards. But remember – your score is always changing! Keep up the good work to keep your score where it is.

My Credit Score is 740-799

These scores are considered to be Very Good. 55% of Americans have a FICO score of 740 or higher, which is good news for them! These scores are most likely to reflect behavior such as consistent on-time payment history and low credit utilization.

My Credit Score is 670-739

If you find yourself in this range you’re close to the average FICO score in the United States, which is 706. It’s always worth it to check your credit report for errors and resolve them. 5% of Americans have an error on their credit report that, when resolved, can get them better rates and terms in the lending market.

My Credit Score is 580-669

Considered Fair credit, folks in this range can be encouraged by the fact that you can boost your score 30-60 points in as little as 6-12 months. For example, the ‘New Credit’ category above is only reported for 12 months. So if you went a little credit crazy and opened 5 new accounts in the same day, that data will drop off your report as a factor in just one year. Keep making those on time payments and with an eye on your utilization, you can boost that score in no time.

My Credit Score is Below 580

Poor credit is considered to be 580 or below in the credit scoring world. The good news is there is plenty of room to grow from here! Pick one of the categories out of the Big 5 that you think would be the easiest to work on. In less than a year, taking some simple steps can bump you up to the next credit score range and open up a world of new possibilities. You’ve got this!

How to Track Your Credit Score Chart Progress

First, go to annualcreditreport.com and get a copy of all three bureaus’ reports. Check for errors and read the full free credit reports thoroughly (fair warning, they can be dozens of pages long!) This is something everyone should do once per year.

Next, keep tabs on your credit score with daily updates, reporting, tracking and money saving offers with that Free Credit Score tool we mentioned earlier. While your annual report is helpful for many reasons, they don’t include your free credit score!

To make sure you know your credit status at all times, you simply log in to online banking if you're a current member. Once logged in, you'll see the free credit score chart widget pop up in your online banking dashboard.

Maybe you want to dig further into your credit report and get an expert opinion on what's going on. Thankfully, we have a benefit for our members through our partner GreenpathTM ; they offer free debt counseling, credit report analysis, and more.

We hope this credit score chart and explanation of the 5 key factors helps you as you continue to build your credit score onward and upward!

Sources:

greenpath.com

www.myfico.com

https://www.equifax.com/personal/education/credit/score/what-is-a-credit-mix/#:~:text=Simply%20put%2C%20a%20credit%20mix,of%20calculating%20credit%20scores)%20used.

https://www.nerdwallet.com/article/finance/late-bill-payment-reported

https://www.thebalance.com/will-multiple-loan-applications-hurt-my-credit-score-960544

https://www.fico.com/blogs/average-us-ficor-score-716-indicating-improvement-consumer-credit-behaviors-despite-pandemic

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval.

.png)