Introduction

Let’s get real - most of us have debt. Some of us have a ton of it. Between school loans, auto loans, mortgages, credit card debt, or some combination of the above, coming to terms with your bottom line can be incredibly overwhelming. Figuring out how to find debt relief seems like a huge process, but in this bundle we’ve got you covered!

You’ll get:

- A plan to figure out how much per month you should be putting towards your debt

- Definitions and examples of two popular debt payoff strategies

- Step-by-step guides for how to pay off debt in the way that fits you best

Grab your statements, grab your calculator and let’s dive into efficient debt payoff.

Debt Directable Dollars: First Step to Debt Relief is to Stop Overpaying

.png?width=853&name=_How%20much%20can%20I%20afford%20to%20put%20towards%20my%20debt__%20(1).png)

Answering this question is the most important place to start.

Your Debt Directed Dollars number (DDD) is the amount of money you can allocate to debt payments each month, while still covering necessities and avoiding creation of new debt anywhere else.

Not sure how to calculate this? Not to worry!

By downloading our bundle, you'll get the entire infographic free to walk you through the process.

Here are the main steps, summarized below:

- Determine income

- Subtract basic necessity living expenses

- Subtract other expenses, such as entertainment and savings

- Find your Debt Directed Dollars number

- Determine the minimum payments needed for all your debts and subtract the total from #4.

- Choose a strategy in the next section (below) for debt relief, then complete your debt inventory.

Debt Relief Option 1: Fixed Payment Method

What is the Fixed Payment method (FPM)?

The Fixed Payment Method of debt payoff focuses on small, easy changes adding up to big savings. Instead of paying the ‘Minimum Payment Due’ each month on each of your loans (which changes month to month), you’ll determine a set (fixed) amount that you’ll pay every month, usually slightly higher than the first month’s minimum.

What does the Fixed Payment Method look like in real life?

Luca’s credit card bill says the minimum payment due is $56.60. Using FPM, he decides to pay exactly $60 per month, every month, no matter what the minimum payment is. As the balance goes down, the minimum payment required goes down, and the ‘extra’ going towards the principal each month will increase.

How do I use the Fixed Payment Method to pay off my debt?

- Gather all loan info – statements or similar that include outstanding balance, minimum payment, and APR (rate).

- Determine your Debt Directed Dollars (DDD) number by downloading our helpful infographic above. DDD is the maximum amount of money you are able to pay towards debt, in any given month, without neglecting bills or savings, and without creating new debt anywhere else.

- Complete the debt inventory and instructions.

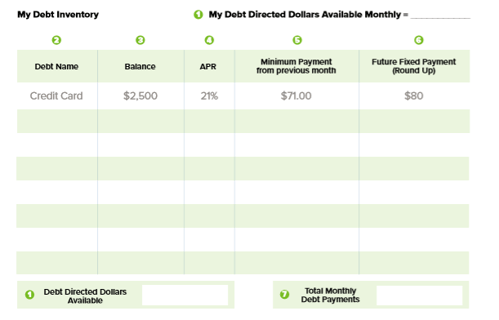

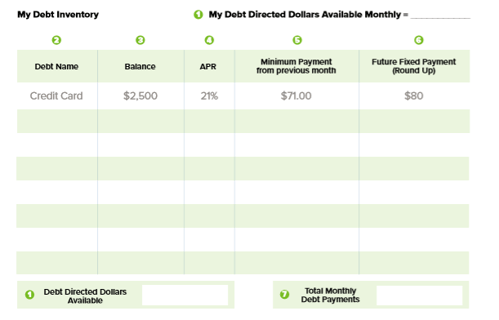

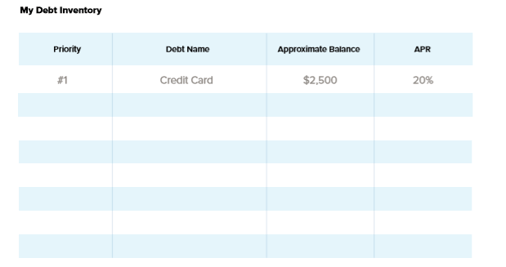

Complete Debt Inventory

- Write your Debt Directed Dollars.

- List each debt by name.

- Write an approximate balance for each.

- Note Annual Percentage Rate. You can find this info on your statement for each debt.

- Take a look at last month’s minimum payment amount and write it in column 5.

- Round the minimum payment number up a bit, and put that amount in column 6.

- Total your Monthly Debt Payments. Does this number equal your DDD amount?

Debt Relief Option 2: Payment Roll Up Method

What is the Payment Roll Up Method (PRM)?

The Payment Roll Up Method of debt payoff allows you to choose one focus debt to tackle at a time. All other debts get a minimum payment while your focus debt gets the remaining available funds. Once that first focus debt is paid off, you’ll be able to ‘transfer’ that payment amount onto the monthly payment for your next focus debt.

What does the Payment Roll Up Method look like in real life?

Sheryl is able to put a total of $300 per month towards her debt. She has three debts currently, and their minimum payments are listed below:

- Credit card minimum payment: $50

- Hospital bill minimum payment: $60

- Auto loan minimum payment: $125

Sheryl chooses her credit card to be her focus debt. That means she makes the minimum payments on the hospital and auto loans (total $185) and the rest of her available funds go towards the focus loan ($115 to her credit card.)

The credit card is paid off in 6 months, and then that $115 can be used to start paying down her second focus debt.

Find out more about how you can boost your credit score based on factors from the credit score chart.

How do I use the Payment Roll Up Method to pay off my debt?

- Gather all loan info – statements or similar that include outstanding balance, minimum payment, and APR (rate).

- Determine your “Debt Directed Dollars” or “DDD” number by downloading our helpful infographic above. DDD is the maximum amount of money you are able to pay towards debt, in any given month, without neglecting bills or savings, and without creating new debt anywhere else.

- Complete the debt inventory and instructions on the following page.

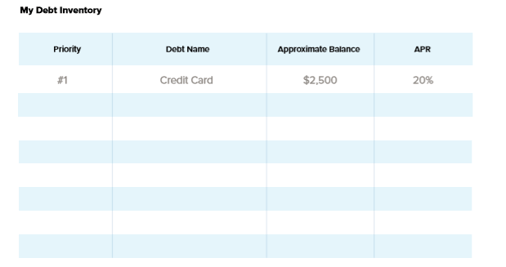

Complete Debt Inventory

- List each debt by name.

- Write an approximate balance for each.

- Note Annual Percentage Rate. You can find this info on your statement for each debt.

- Choose a focus debt

- Lowest Balance

or

- Highest Interest

- Number the rest of your debts in the order they'll be paid off, following whichever option you choose in step 4.

Make a Payment Plan

- Plan for minimum payments on all debts except focus debt.

- Focus Debt Payment Calculator:

Helpful Tips:

- Make it automatic, if you can. Ensure you’re making minimum payments only to all other debts. Set up an automatic payment for your Focus Debt as well!

- Get excited about debt payoff! You can calculate how much quicker you’ll be paying off debt by entering your info into PowerPay by Utah State University. They’ll share a calendar that will show your monthly and yearly progress.

Conclusion

We hope that by using these resources, you now have the confidence to tackle your debt. When you have the tools and knowledge you need to reach your financial goals, and you’re on your way to debt relief and financial prosperity, this means we’ve done our job!

Another excellent option that we don’t discuss in the resources above, but that we do offer, is debt consolidation. If you have high-interest debt burning a hole in your finances, you may want to chat with one of our experts about a debt consolidation loan. Read more about our options here. You can also check out debt counseling and credit counseling services for free, as a member benefit, with our partner Greenpath. Learn more about the secret to a good credit score.

Resources

Copper State Credit Union has free budgeting resources for you if you need to update your household budget before tackling debt.

Copper State Credit Union also offers you the chance to find out your financial health score for free. See what a financial assessment could do for you.

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval. Membership is required.

.png?width=853&name=_How%20much%20can%20I%20afford%20to%20put%20towards%20my%20debt__%20(1).png)