Our Vision + Values

We are dedicated to helping our members achieve their financial goals through empowerment. We recognize that not all families look the same and not everyone has the same idea of what financial success looks like. That’s why we’re here to help guide, answer questions and provide our members with the resources needed to achieve financial prosperity.

FAMILY

First and foremost, we value family. Our Copper State Credit Union family of employees, the member-families we serve and the families in our communities.

EMPOWERMENT

We value empowerment. We strive to empower our members with financial education, knowledge and tools to help them reach their goals. We also strive to empower our employees, giving them the tools they need to reach their career and personal growth goals.

DISCOVERY

We value discovery. We embrace a culture of curiosity and innovation. We encourage our members along with our employees to be courageous and forthcoming with new ideas.

EXCITEMENT

We value excitement. We aspire to make finances a positive and exciting experience for our member-families as well as our employees so everyone has a shared excitement to be part of our credit union.

RESPECT

Finally, we value respect. We prioritize a respectful environment for our staff and an uplifting community for our members where all treat one another as equals. We purposely appreciate the unique value each person brings to our credit union by practicing collaboration, kindness and empathy.

.jpg)

Supervisory Committee Report

The Supervisory Committee of Copper State Credit Union provides the membership with an independent appraisal of the safety and soundness of Copper State CU’s operations and activities in compliance with credit union bylaws, Arizona law and the Federal Credit Union Act. The committee is comprised of six credit union members who are appointed by the Board of Directors. The committee meets bi-monthly to review and discuss the results of internal audit recommendations and the status of outstanding management’s actions on all prior recommendations. The committee meets with examiners from the National Credit Union Administration and the Arizona Department of Insurance and Financial Institutions during regularly scheduled examinations to ensure your assets are secure through the implementation of sound financial policies, procedures and controls. The Supervisory Committee employs the independent accounting firm of Doeren Mayhew to perform a comprehensive audit of the credit union’s year-end financial statements.

In addition, the Supervisory Committee works independently on behalf of Copper State CU members to ensure that questions or issues pertaining to individual member accounts are resolved. We are pleased to report that based on this work, Copper State CU operates with a system of strong internal controls and is a sound financial institution.

On behalf of the Supervisory Committee, we are proud to be part of the Copper State CU organization and look forward to continuing the long tradition of providing financial security to our members.

Respectfully submitted,

David Matson

Supervisory Committee Chair

Board Chair and CEO's Report

Dear Members,

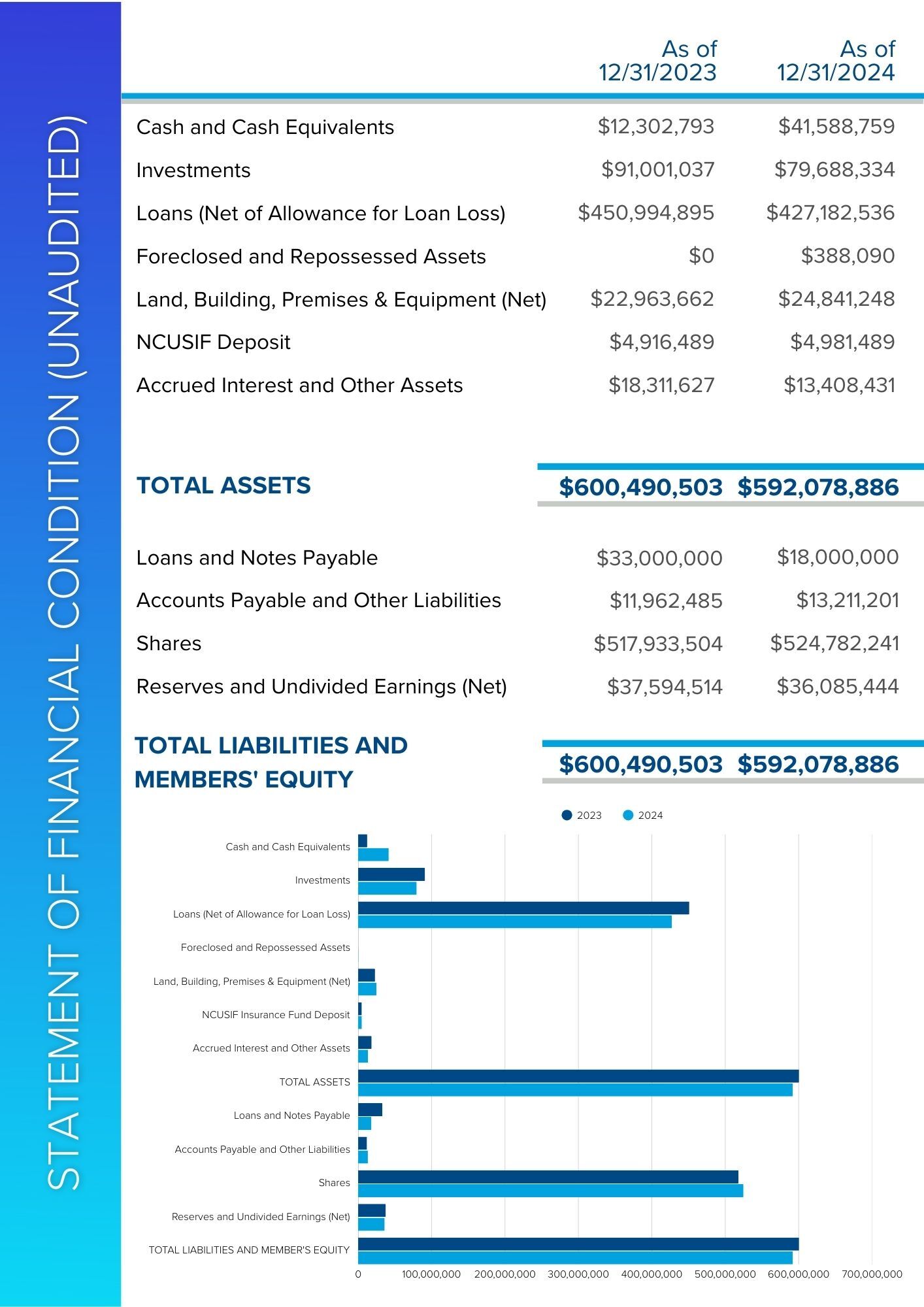

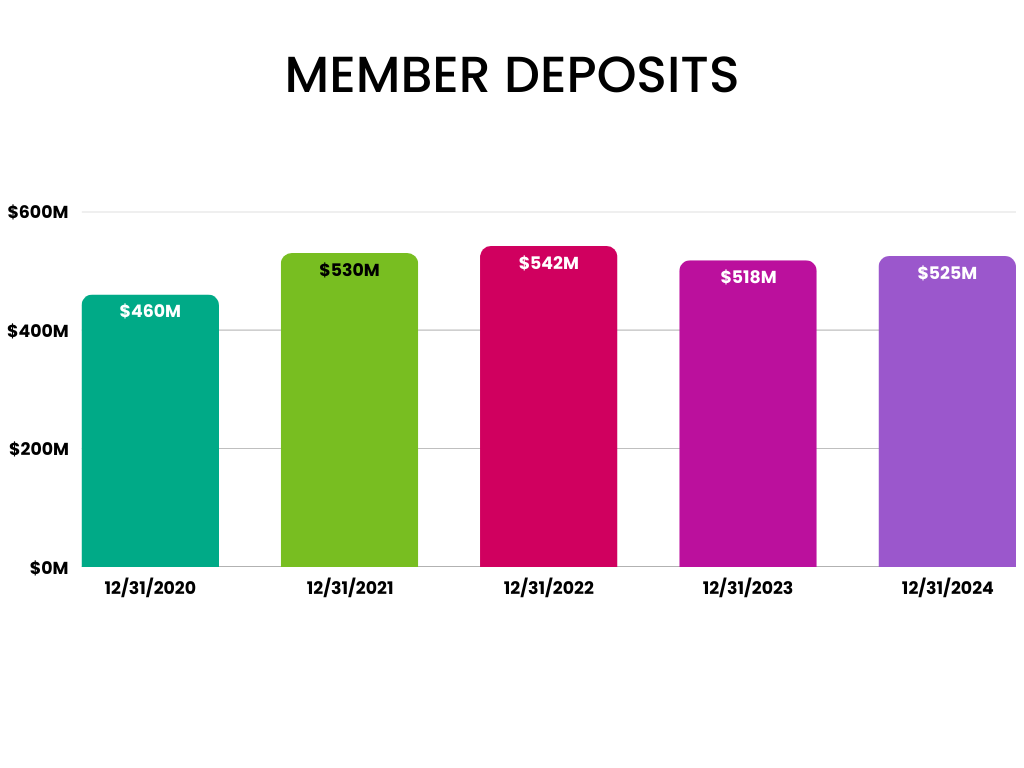

Thank you for your active membership in our credit union. Since 1951, Copper State Credit Union has provided valuable financial services and advice to our member/owners. Our goal is to gather, protect and grow members’ assets and fund their lives. In 2024, membership decreased by 1,461 members to 43,441. Member deposits grew by $7 million to reach a new high of $525 million. Member loans decreased by $24 million and ended the year at $427 million. Members increased investment assets held under management by $16 million with a year-end balance over $117 million. Overall, members continue to invest in our credit union and rely on financial services to save time and money.

Safety and Soundness

Our credit union continues to be considered “Well Capitalized” due to a net worth ratio of 8.37% (reserves/assets) and a risk-based capital ratio of 11.76% as of December 31, 2024. This includes almost $48 million in reserves accumulated over our 74-year history. We are highly regulated by the Arizona Department of Insurance and Financial Institutions. Our members’ deposits are insured by the full faith of the United States through the National Credit Union Administration (NCUA). The deposit insurance through National Credit Union Share Insurance Fund covers individual member deposits up to at least $250,000. The insurance can cover an even larger deposit amount when additional account owners or beneficiaries are included, or other structuring occurs. Visit mycreditunion.gov/insurance-estimator to find out your specific level of coverage. Historically, credit union members in the United States have never lost even a penny of insured savings at a federally insured credit union.

2024 Enhancements

Due to our not-for-profit status, we reinvest our earnings back into our credit union operations to improve products, rates and convenient access for members. Thank you to thousands of our members who provided valuable feedback and recommendations every day through our multiple channels of feedback. Members continue to give Copper State Credit Union some of the highest marks for service, products and advice.

In 2024, we improved many areas of our credit union including:

- Paid top tier rates on deposit accounts and maintained low loan rates and fees compared to our local competition

- Centralized loan experts to provide better service and advice

- Transferred IRA funds to Wealth Management accounts to better serve members’ retirement strategies

- Improved our Solution Center (Contact Center) with additional staff, training, after hour support, new phone system and technology to better route calls and requests to better serve members

- Remodeled the Goodyear and Payson branches to provide better service and advice to members in those communities

- Upgraded ATMs to newest technology and relocated them to the member-preferred drive thrus

- Modernized and increased usage of our payments systems including remote deposits, overdraft protection, ACH, debit and credit cards, FedNow and RTP

Governance

Because of our unique structure as a cooperative, each member has the unique and important responsibility to elect our Board of Directors. These Directors are elected to serve the entire membership and provide leadership and vision for the long-term success of our credit union. We have been fortunate to have some of the best visionary leaders serve on our Board. Currently, our 8-member (soon to be 9) Board has served an average of 7 years. The Board appoints the Supervisory Committee made up of 6 members with an average tenure of 11 years. Due to Board policy on term limits, we thank Paul Waterman, Director and former Board Chair for his leadership over the past 9 Years.

Thank you for your membership and continued support and participation.

Dennis McDonald, Chair of the Board

Robb Scott, President/CEO

2024 Financials

.jpg)

.png)

.png)

Copper State Credit Union

In 2024, we improved many areas of our credit union including:

.png)

Credit Manager's Report

Providing credit for members to “fund their lives” continues to be the main reason we exist.

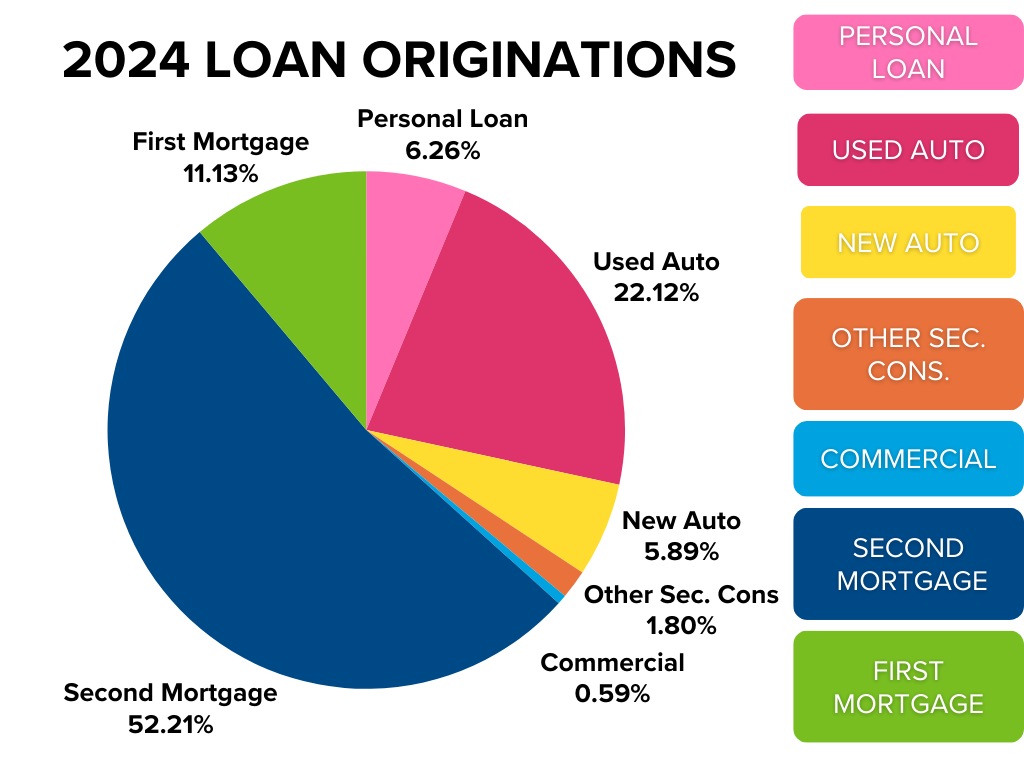

In 2024, we continued to meet the memberships’ loan demand as evidenced by funding over $123 million for vehicle, home and home equity, personal and small business loans. Loan balances decreased by over $24 million in 2024 due to a slowdown in home purchases and other large purchases due to higher rates and higher prices. We also shifted our focus to increasing loan business with our current members versus new members through indirect and direct channels ahead of our February 2025 system conversions.

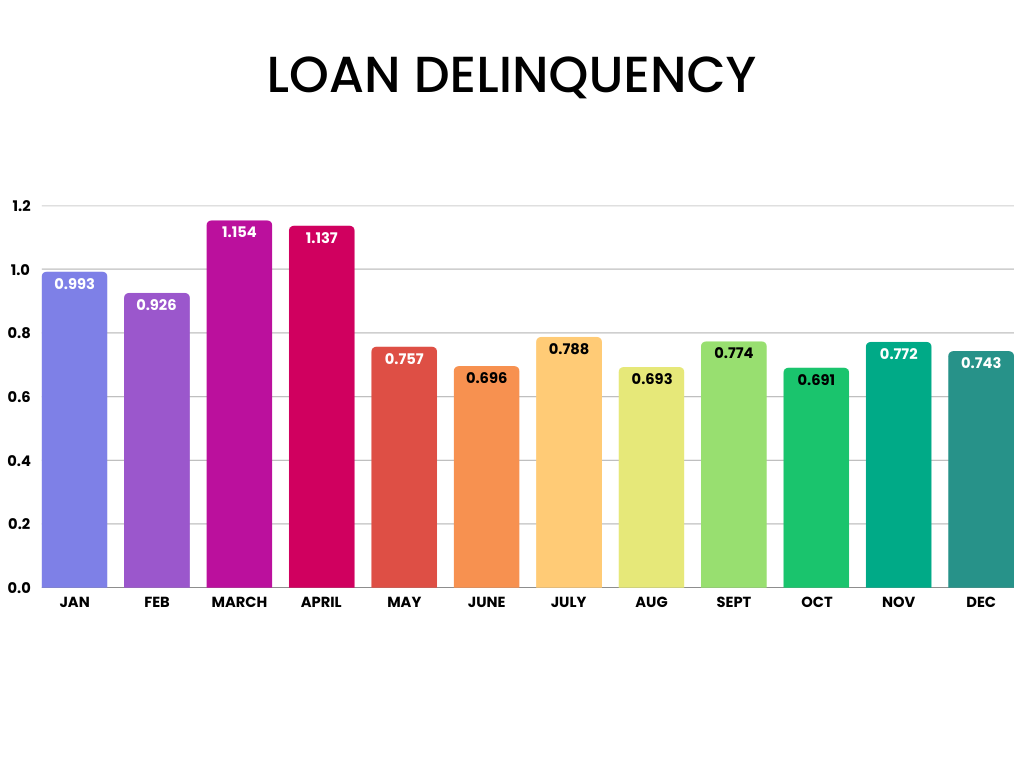

We continue to be an excellent source of credit for our members due to our lower rates and fees charged for credit and our local underwriting. Our members continue to perform well with the use of credit as evidenced by our combined loan delinquency and loan charge off experience in 2024. Just over 98% of member loans are paying as agreed.