5 Simple Steps to Take Control of Your Savings Plan

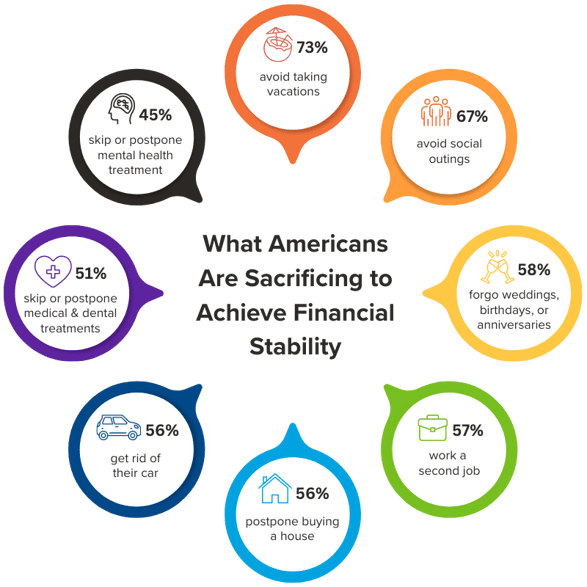

Earlier this year, Moneyzine conducted a research study to find the "perfect paycheck." The study found that nearly all U.S. residents report needing a salary of $100,000/year to be happy. For many of us who fall short of our ideal income, we tend to say "no" a little more often. These common sacrifices may not be much of a surprise to you.1

In a challenging economy with high costs of living, layoffs, and inflation, cutting corners and making sacrifices has become the new norm. It's now more critical than ever to establish a personal savings plan. As many of us know, the time to create a savings plan is not once you need the money most.

We want you to have cash on hand for when you really need it later – whether an emergency occurs, it’s time to retire, or you're just sick of saying "no" to things you need or want to buy. So, we've prepared five simple steps to help you take control of your savings plan.

Be advised! Although these steps are simple and straightforward, they're not always easy.

1. Start Somewhere

Even if you have a negative balance in your account or just have a few dollars to your name, the good news is it’s never too late to start saving. The first step is to take action. Whether you want to open a high-yield savings account or just throw spare change into a jar, do something.

Put saving on the front burner. Rather than waiting until all your bills and expenses are paid and saving any extra you have left, prioritize saving. Make it a fixed item just as you would your rent or utility bills. Overspending happens when people don’t prioritize or know where their money is going. If you already have your savings set aside, you won’t be able to unconsciously spend it on something you don’t really need. A great way to keep track of this is by creating a zero balance budget plan.

You may want to check out some of the best savings accounts available to help you save. They include high-yield savings accounts and standard accounts. The benefit of opening a high-yield account is that you’ll reach your goals faster. These accounts offer more when it comes to interest earned. Add that to what you are able to put into the account, and it multiplies faster.

Certificates of Deposit (CDs) are another great option for a higher return on your cash. CDs earn more in interest, but to receive that promised return, your deposit will have to be locked-in for a longer period of time. These are great for time-based savings goals! For example, if you know you'll need to pay for tuition next year, you can set up a six or twelve month CD for that specific purpose. When you're mindful of the term and when you need the money by, it all works out.

Don’t be afraid to pay yourself first. It may seem a bit selfish to put savings away before handling other expenses or donating to charity, but if you don’t financially take care of your future, you won’t even have the cash you need to pay those other expenses. It’s not selfish, and when you are financially stable, you are able to help others more plentifully than you could if you were living paycheck to paycheck.

2. Set Savings Goals

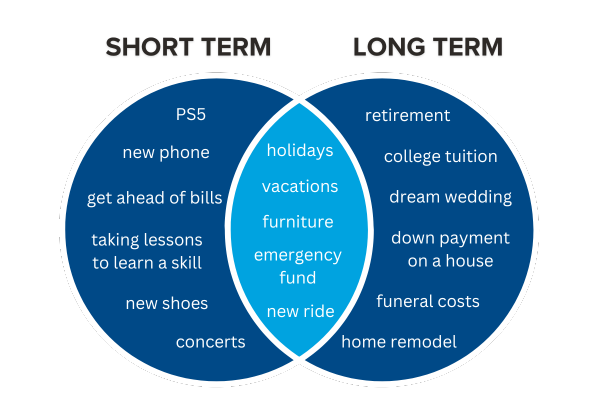

A big part of making a personalized savings plan is realizing why you want to save in the first place. Depending on your situation, you may want different accounts for different goals.

Once you know what you want to save for, try to break those up into short term or long term goals. This will help you set a timeline to achieve those savings goals and select the right savings account.

Traditional savings accounts are popular for short term goals so you have flexibility to pull the cash out at any time. For long term savings goals like retirement or education, CDs and 529 education savings plans are popular options, respectively.

Remember, our team is available to help you select the right savings account for your needs. 🙌

Keep in mind, you may have a high-yield savings account for a certain purpose, like retirement, but it doesn’t have to all go towards that. Consider breaking it down into other categories. For example, you might put 70% of your savings towards retirement, 10% toward an annual holiday, and 20% toward a family vacation. Then, when the vacation or holiday comes around, you will already have cash available for that specific reason, and probably won't feel as guilty spending it.

Be sure to check with your financial institution to understand the guidelines surrounding withdrawals, and plan around them. For example - if you are allowed two withdrawals without consequence each year, schedule your savings to reach the vacation or holiday amount by the time you are allowed the transaction.

Need help saving? Here are two coaches to walk you through the process:

Savings is a commitment, not an amount.

3. Make Healthy $ Habits

Take Advantage of Automatic Transfers

You might already use automatic services to pay the big bills you have, so now that your savings account is a fixed priority, set up automatic transfers for that too. Set it and forget it, so you won't have to worry about making the transfers yourself. Perhaps set the transfer to take place the day after payday - or have your direct deposit go straight to your savings account. This way, you can count on a regular, automatic contribution to a consistent savings plan.

Treat Bonuses as Bonuses

When you receive a bonus at work, a financial gift from a loved one, a tax return, or even extra cash from selling something, treat it as a true bonus. Consider putting most or all of it into your savings account. The greater sum of money you have in the account, the greater savings it will yield. If it’s extra money, you won’t have it designated to other expenses, so you may as well put it away.

Try a Few Savings Hacks

- 🌎 Make 3 Simple Life Swaps to Save Money and our Planet

- 🍍 Save Money at the Grocery Store

- 💸 Increase Your Pay with Salary Negotiation

Track Your Money

Knowing where you spend your cash is half the battle. A little bit of record keeping can help you pause and reflect on your spending habits each month. An easy way to do this is with a free budget template. Pull up your financial accounts to estimate your transactions - you'll want to input your income, expenses, and savings goals for a zero balance budget. This way, every dollar has a purpose. ✔️

4. Plan for Emergencies

The truth is, we all need enough in the bank for when 💩 *stuff* happens. AKA, an emergency savings fund. There are emergencies that you just can’t foresee. This can include the loss of a job, a natural disaster, a health concern, or the passing of a family member.

Some people choose to keep their emergency cash at home rather than at a financial institution so they have it right when they need it. Although this is ultimately your choice, keep in mind the security risk of having large amounts of cash at home, as well as the loss in earned dividends from keeping it in an account. As inflation increases, the value of your cash decreases. On the other hand, if you choose to keep this fund at a bank or credit union, consider depositing it in a separate account so you know it's strictly for emergencies (and you're not tempted to spend it).

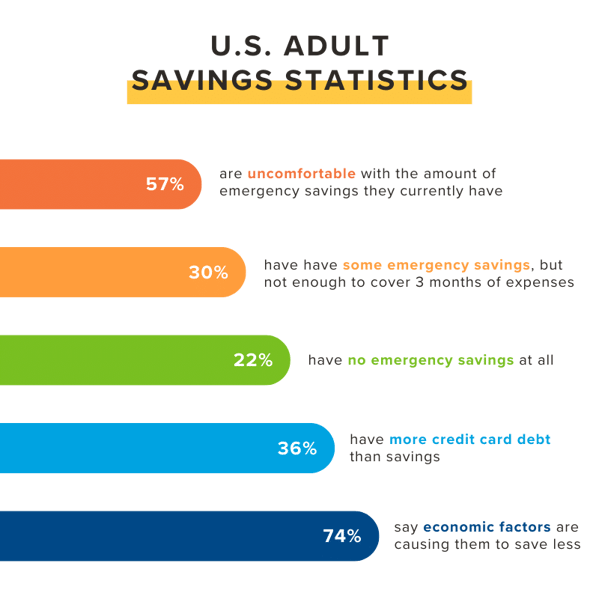

Begin your emergency fund with as much as you can spare, and work up to your goal amount. Once you have reached your goal, it's recommended you save three to six months’ worth of expenses. After experiencing an emergency, and when you are financially stable again, build it back up.

According to a recent Bankrate survey, nearly one in four adults have no emergency savings at all. Younger Americans are more likely to have little to no emergency savings, since many of them haven't built up a saving habit yet.2

5. Build Your A-Team

There’s no better time to start saving. Whether you feel confident moving forward or need a little more information, we're eager to help you on your financial journey.

Take advantage of the free resources available to you!

😘 Contact Copper State Credit Union >>

🙌 Get in touch with a GreenPath financial counselor >>

💻 Browse more saving resources >>

💰 Watch Make it Make Cents YouTube Shorts >>

If you decide to open a new savings account, the best way to do so is by going to a branch and speaking with an expert. You may have questions, and they have answers. Here are some items to inquire about:

-

What type of savings account should I open? – There are regular savings accounts, high-yield savings accounts, CDs, money markets, and more. Discuss what you plan to use your savings for so he or she can guide you to the best account to fulfill your needs.

-

What is the minimum initial deposit? – Each account will have a minimum required initial deposit. Be sure you understand what it is before you get too attached to the idea of a certain type of savings.

-

Is there a withdrawal penalty? – If you open the right type of account, you shouldn’t have to worry about early withdrawals. Just to be safe, make sure you understand whether or not there is a penalty for doing so.

The more knowledge you gain, the more success you’ll see with your savings plan. 😉

If you want to take a closer look at your budget before you begin a savings plan, check out our Ultimate Budget Plan to Save You Time and Free Your Money, a free eBook guide.

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only.

Sources

1 Moneyzine https://moneyzine.com/news/2023/05/11/ideal-income-in-each-state/

2 Bankrate https://www.bankrate.com/banking/savings/emergency-savings-report/