Find out the newest tax brackets.

Plan for 2024 contribution deadlines.

Check the

new standard deduction.

Jenn, Employee

What a great resource for filing taxes!

Table of Contents

-

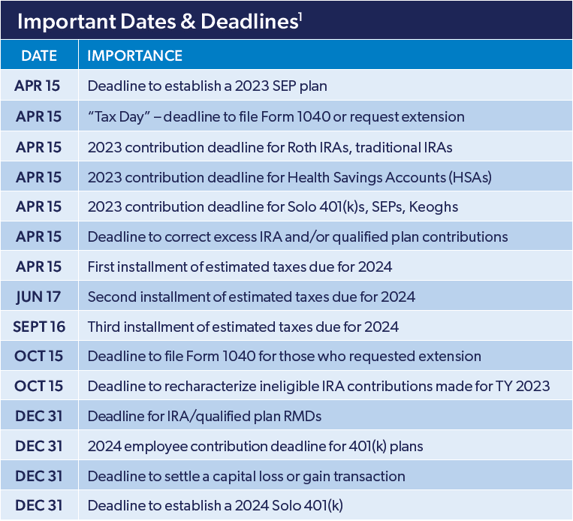

Important Dates and Deadlines for 2024

-

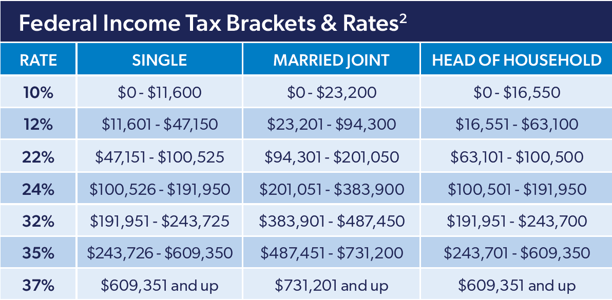

Federal Income Tax Brackets and Rates

-

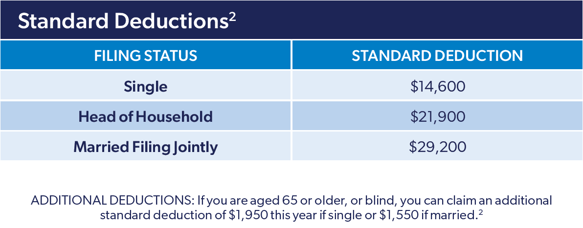

Standard Deductions

-

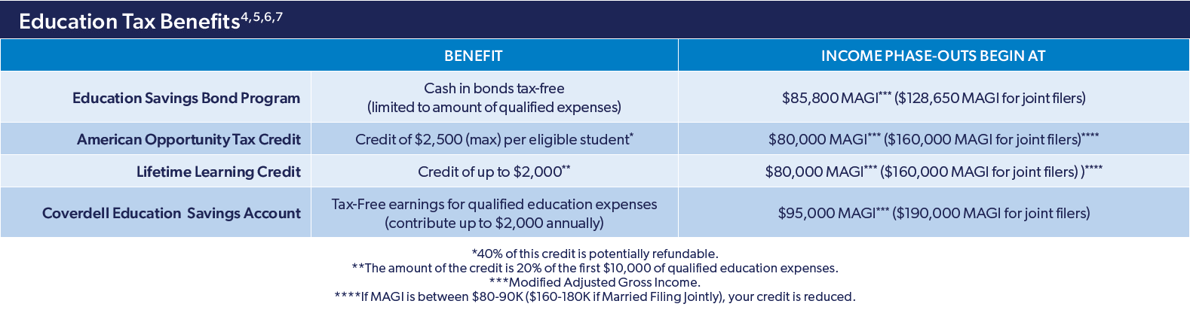

Education Tax Benefits

-

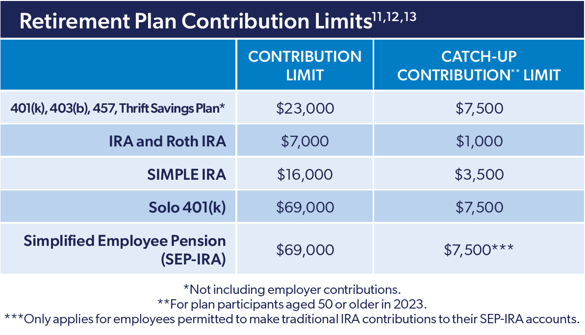

Retirement Plan Contribution Limits

-

Also included in the free PDF:

- Alternative Minimum Tax Exemptions

- Qualified Dividends and Long Term Capital Gains

- Net Investment Income Tax (NIIT)

- AGI Limits and IRA Contribution Deductions

- Estate and Gift Tax Rates, Exclusions, & Exemptions

- Medicare Costs, Deductibles & Coinsurance

- Health Savings Accounts, High Deductible Health Plans

- Social Security and Taxable Benefits

- Extended Care Coverage Deductibility Limits

Send a copy to your inbox now:

2024 Tax Brackets and Deadlines to Know: Quick Reference Guide

This two-page download on 2024 tax brackets will share all the numbers, dates and other things you need to know to be prepared for the rest of the year. We'll share some of the highlights below and the rest will be located on the PDF, once you download it. 😉

In the retirement and investment world, there are a lot of moving variables. We're here to help! We have resources for you such as on-demand articles, calculators and coaches. Here are a few of our favorites:

- Avoid These 8 Retirement Mistakes

- Do I Have Enough for Retirement?

- 4 Really Good Reasons to Invest

- 5 Often Overlooked Tax Deductions

Important Dates and Deadlines for 2024

Federal Income 2024 Tax Brackets and Federal Income Tax Rates

2024 Standard Deductions

Education Tax Benefits

Retirement Plan Contribution Limits

More Opportunities to Grow:

- Take Advantage of Arizona's 4 Most Popular Tax Credits

- Alternative Investments to Look At

- Retirement Checklist: How Prepared Are You?

- Crush Tax Season with a Tax Return Game Plan

-1.png?width=300&name=300x400%20ebook%20cover%20(1)-1.png)

Send a copy to your inbox now:

Investment advisory services offered through PFG Advisors, LLC, a SEC registered investment adviser. Securities offered through Osaic Wealth, Inc., member FINRA/SIPC. Insurance products offered through approved carriers. Copper State Credit Union, PFG Advisors, LLC, and Osaic Wealth, Inc. are separately owned entities and are not affiliated companies.

Not FDIC/NCUA insured | No Financial Institution Guarantee | May Lose Value

This material was prepared by FMG Suite, and the information given has been derived from sources believed to be accurate. This is not intended as a guide for the preparation of tax returns, nor should it be construed as legal, accounting or tax advice. This information is subject to legislative changes and is offered “as is”, without warranty of any kind. Publisher and provider assume no obligation to inform readers of any changes in tax laws or other factors that could affect the information contained herein.

Sources

1-6, 8, 11-13, 15: IRS.gov, 2023

7: Investopedia.com, May 4, 2023

9-10: SSA.gov, 2023

14: CMS.gov, 2023

16: Healthcare.gov, 2023